What Is Form 940 And When Must It Be Filed

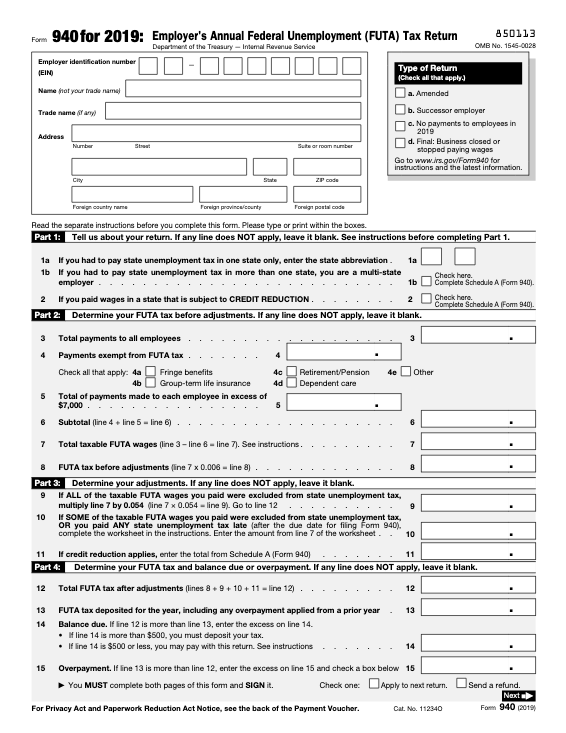

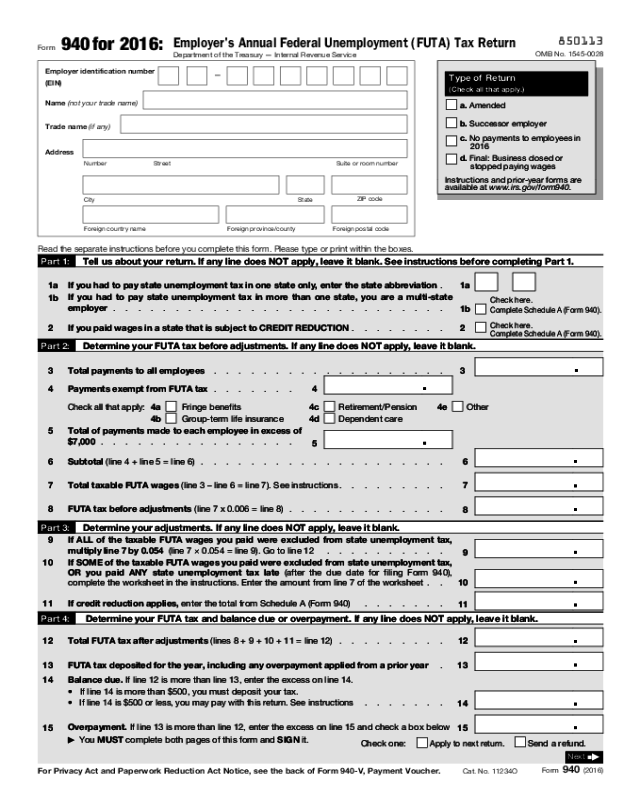

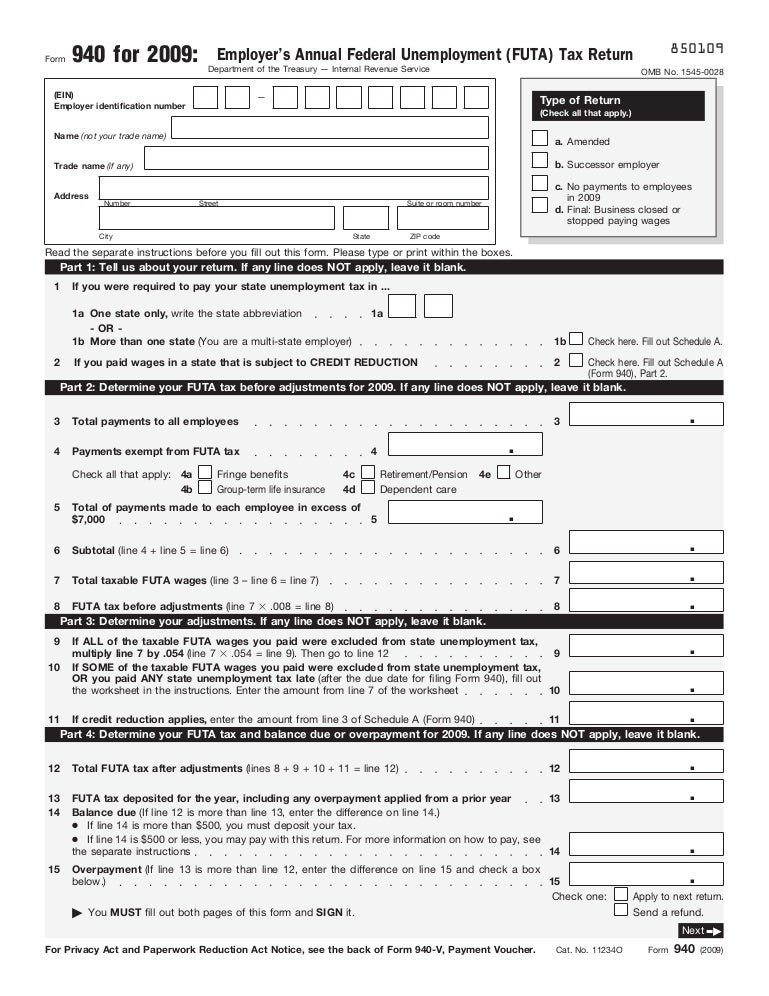

Irs form 940 is the federal unemployment tax annual report.

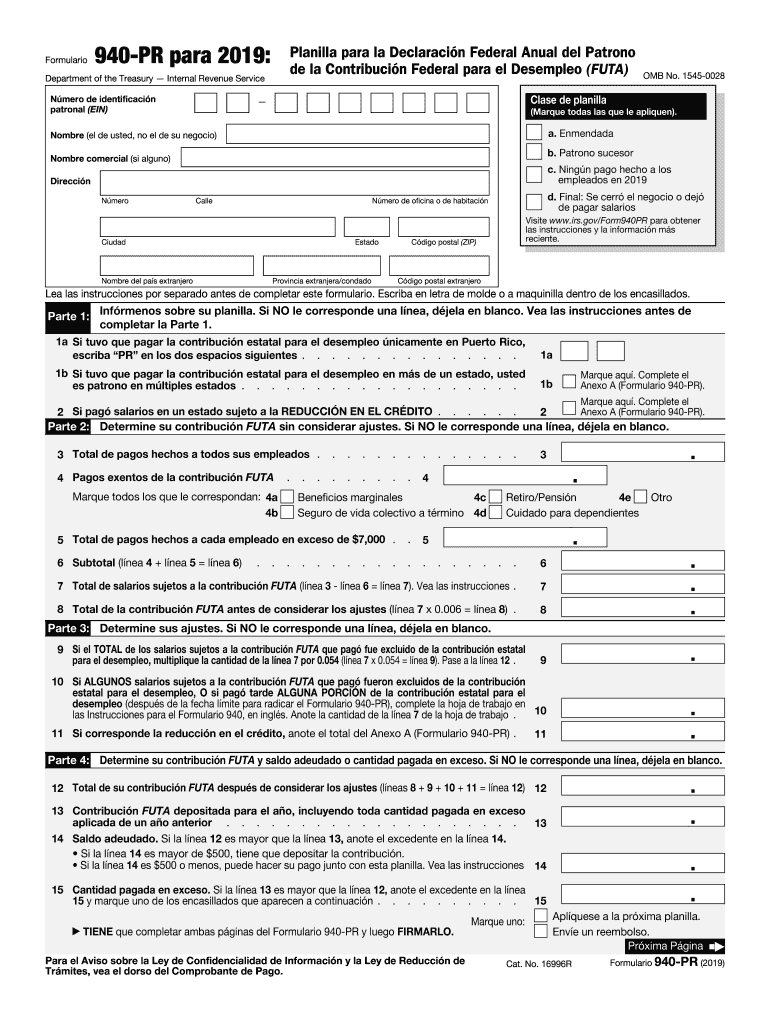

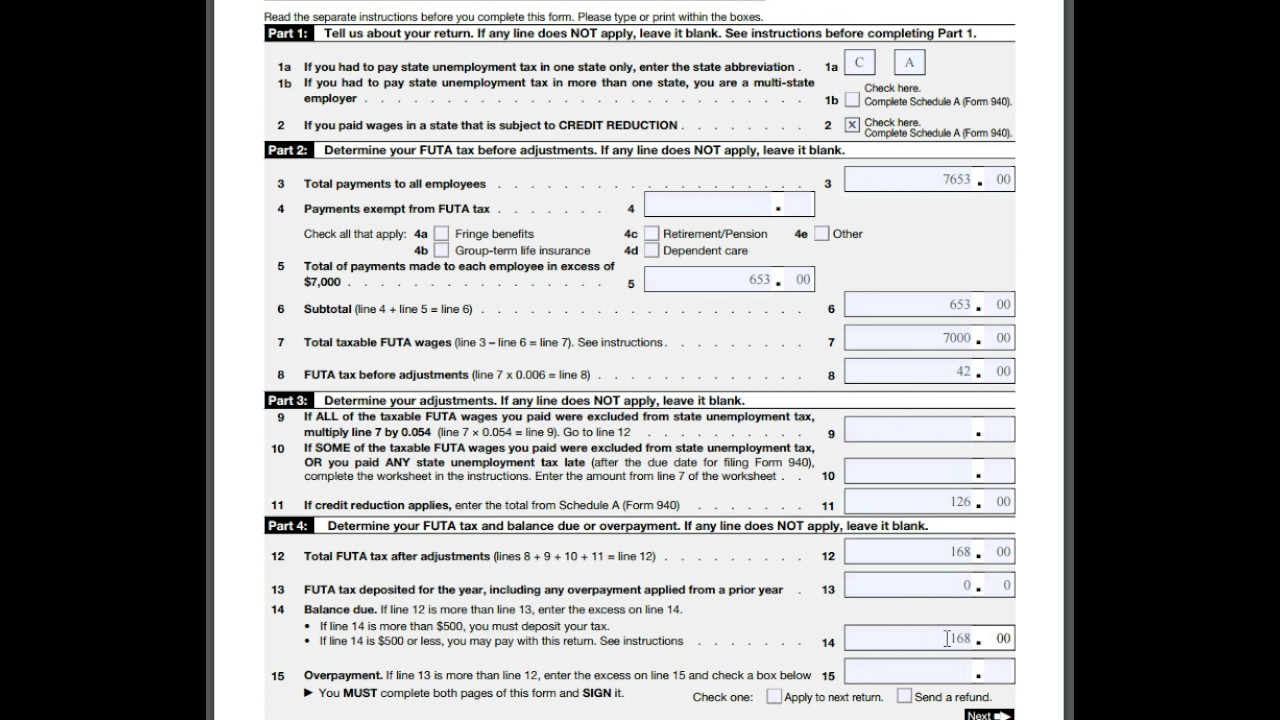

What is form 940 and when must it be filed. They don t deduct these employment taxes from employee pay but they must set aside the appropriate amount and report it on form 940. The due date for filing form 940 for 2017 is january 31 2018. Who must file form 940. Employers must report and pay unemployment taxes to the irs for their employees.

If you file the return on paper it must be sent to the address listed in the instructions on form 940. Form 940 is filed with the irs. Last modified 05 jan 2018 05 01 est. You paid wages of 1 500 or more to employees in any.

How to file form 990 n. You must file form 990 n electronically on the irs website. What is form 941 and when must it be filed. You must file a 940 tax form if either of the following is true.

The 20 weeks do not need to be consecutive. A general test household employees test and farmworkers employees test. You paid wages of at least 1 500 to any employee during the standard calendar year. So you need to file form 941 every three months.

Paid preparers must sign paper returns with a manual signature. You had an employee temporary part time or full time work anytime during 20 or more weeks. The address is based on the location of the employer and whether the form is accompanied by a payment. However if you deposited all of your futa tax when it was due you may file form 940 by february 12 2018.

There are three tests used to determine whether you must pay futa tax. After filing the e postcard the irs will send a notification either accepting the form or rejecting it. Most employers pay both a federal futa and a state unemployment tax. A paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn t an employee of the filing entity.

If you answer yes to either of these questions you must file form 940. Where do businesses file a federal form 940. The form is due every year by the 15th day of the 5th month after the close of your tax year and you can t file it until after your tax year ends. After you file your first form 941 you are required to file a return for each quarter even if you don t have any payroll taxes to report.

The due dates for form 941 are as follows. You have to file this form for the previous year in february of the new year by mailing it with a check if required to the irs. If you are an employer you must determine whether to file form 940 and if so how much to pay in futa taxes.