What Is Debit Note In Gst

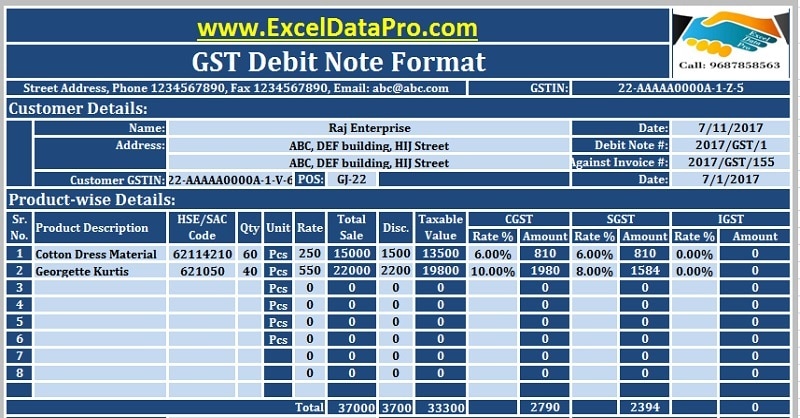

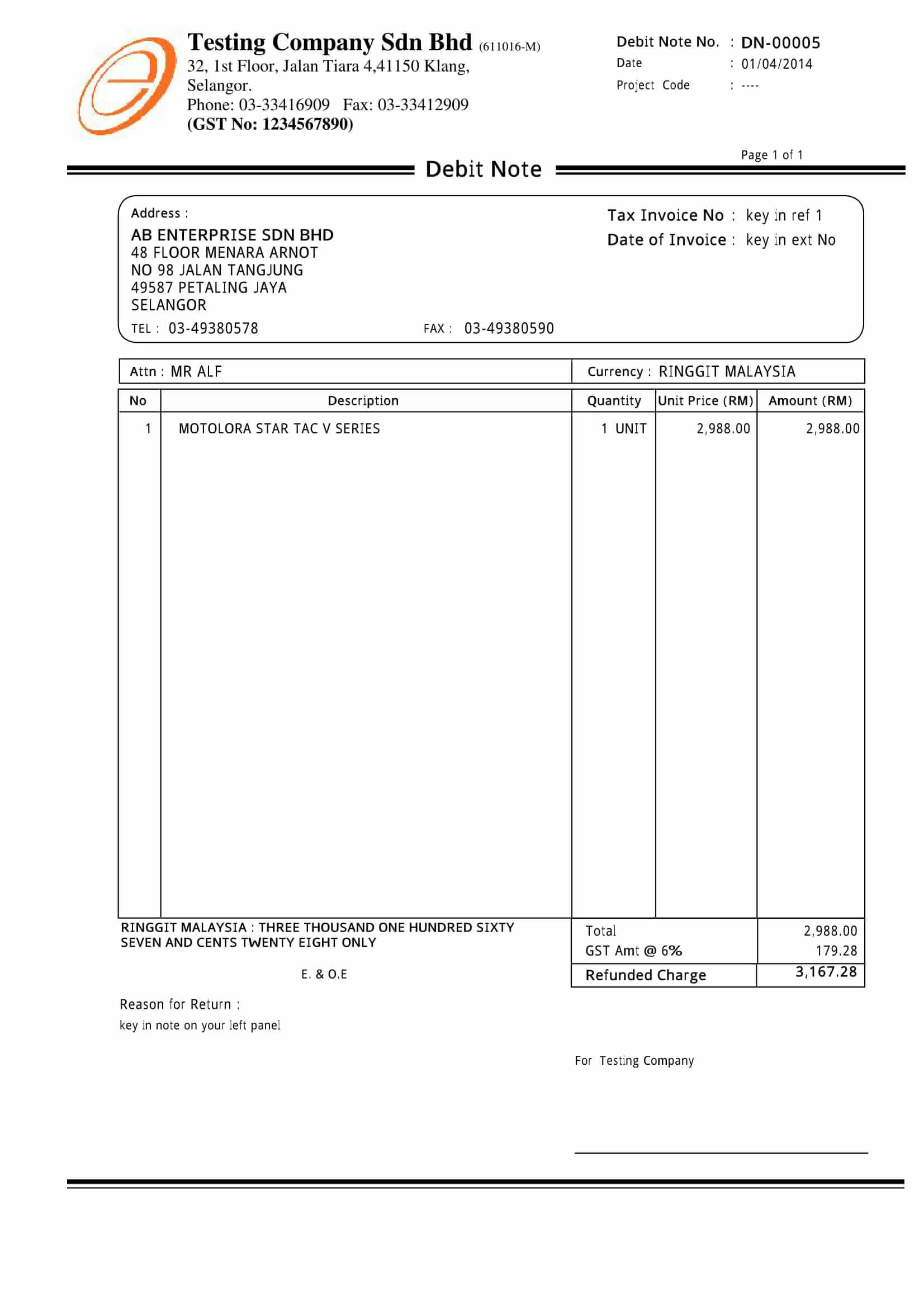

Tax charged in the invoice is less than the actual tax payable.

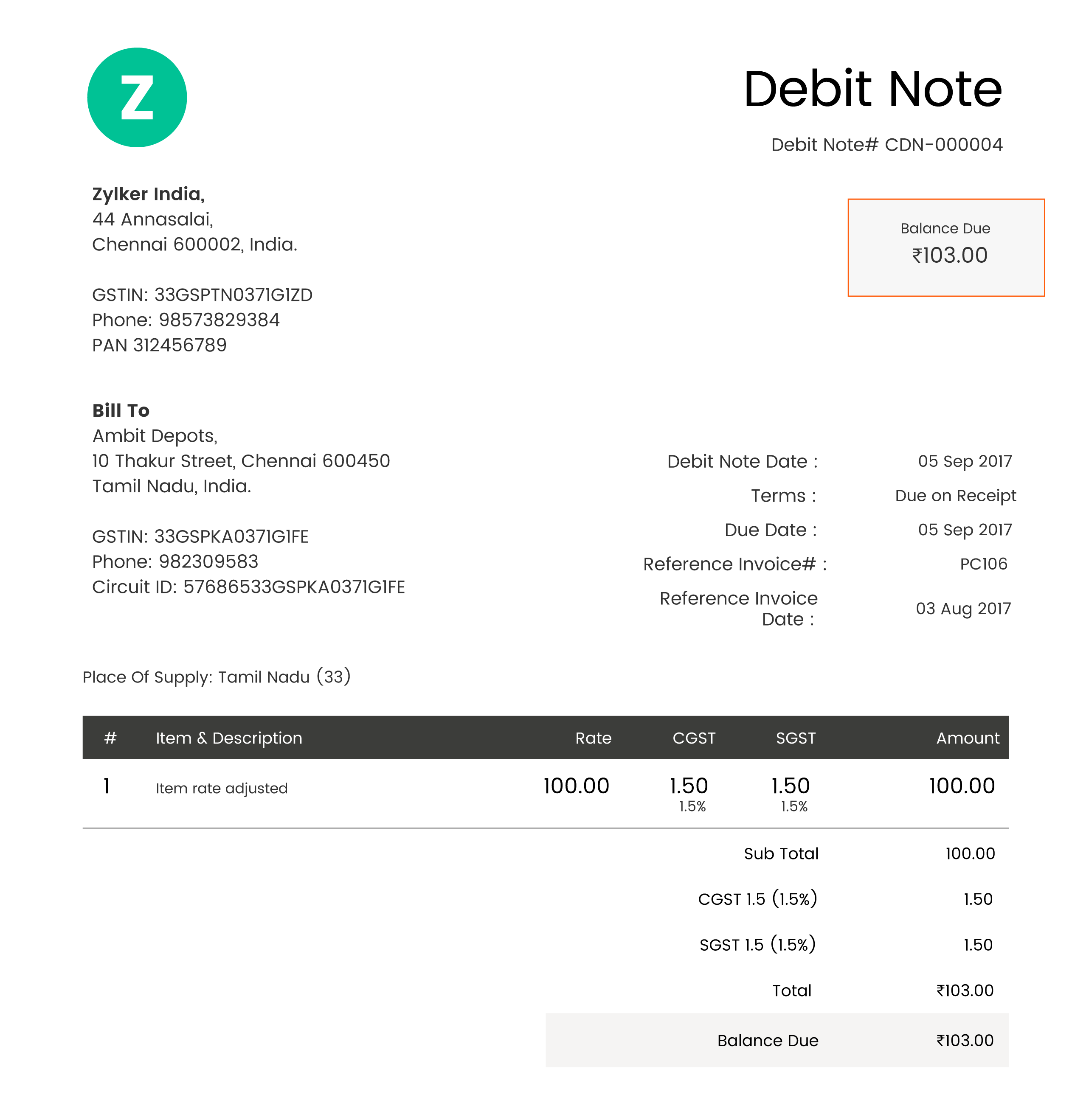

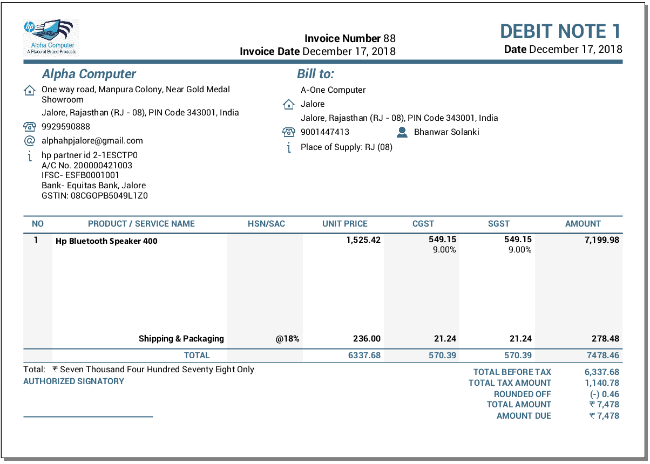

What is debit note in gst. Gst law has however provided them a legal recognition as a document on which tax incidence can be passed or excess tax can be refunded or credited back. Any such document by whatever name called debit note or credit note when issued by the recipient to the registered supplier will not be considered any document under gst law. The issued debit notes details should be provided in form gstr 1 for the month in which it was issued. The word debit note also includes supplementary invoice it is issued when the taxable value present in the invoice is less than the actual taxable amount or.

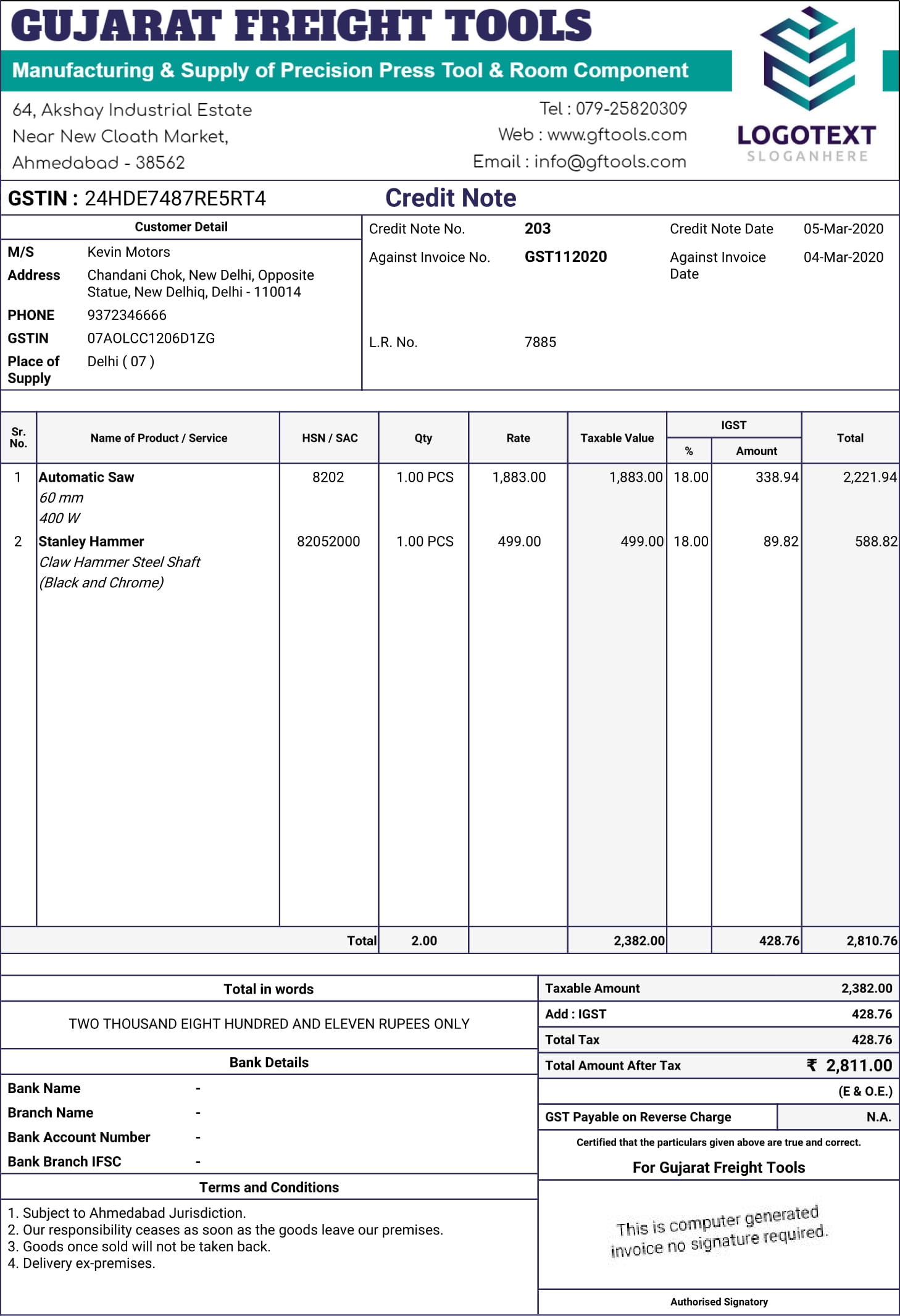

Section 34 of cgst act 2017 details out the provisions on debit note and credit note. In order to clearly understand the concepts of debit and credit note in gst we have to let go of our understanding of debit note under erstwhile laws and begin with a new slate. Please note that a debit note can be raised by a recipient also when the goods received are returned damaged in transit the taxable value shown in the invoice is more than the actual or tax charged is more than the actual. 1 1 credit note section 2 37 means a document issued by a registered person under sub section 1 of section 34 of cgst act 2017.

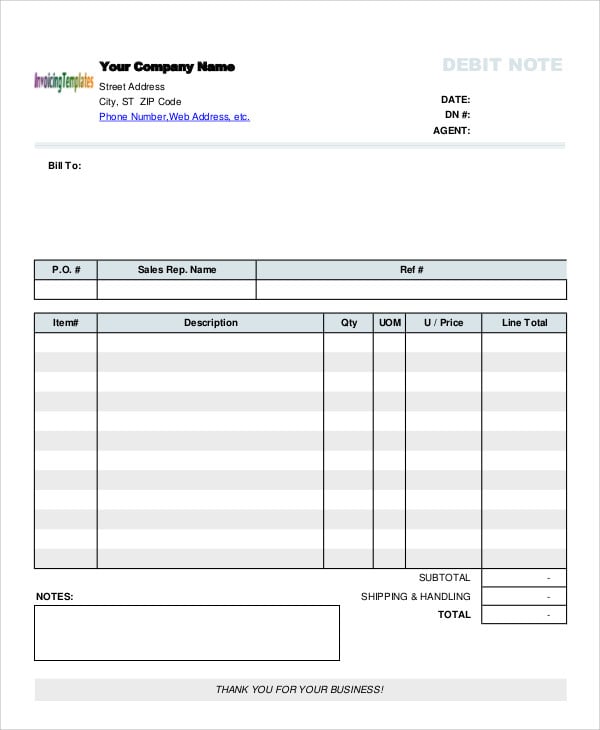

Credit note and debit note under gst 1. It is a document that a supplier of goods or services issues to the recipient where a tax invoice has been issued for any supply of goods or services or both and. For all other standard rated supplies to gst registered customers you must issue a tax invoice or simplified tax invoice if the total amount payable including gst does not exceed 1 000. Debit notes are explained under section 2 38 of the gst law.

A credit note is used to reflect that a credit has been effected to the account of the other party. A credit note and debit note for the purpose of gst law can be issued by the registered person who has issued the tax invoice i e. However under gst debit note furnished by a supplier only will be considered for revision in the values of an invoice. These details are available to the recipient in form gstr 2a post which the recipient needs to accept the details and submit in form gstr 2.

You may issue a debit note to request for payment for transactions where no gst is charged eg. Internal billings within the same company. Debit note or credit note can be issued anytime i e there is no time limit for issuing the debit note. A debit and credit note for the purpose of the gst law can be issued by the registered person who has issued a tax invoice i e the supplier.