What Is Debit Note And Credit Note With Example

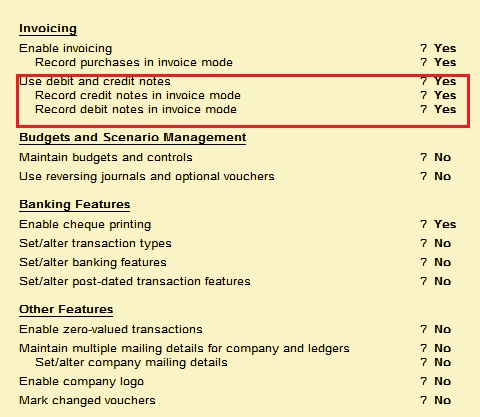

Issuing debit note to record credit received from suppliers.

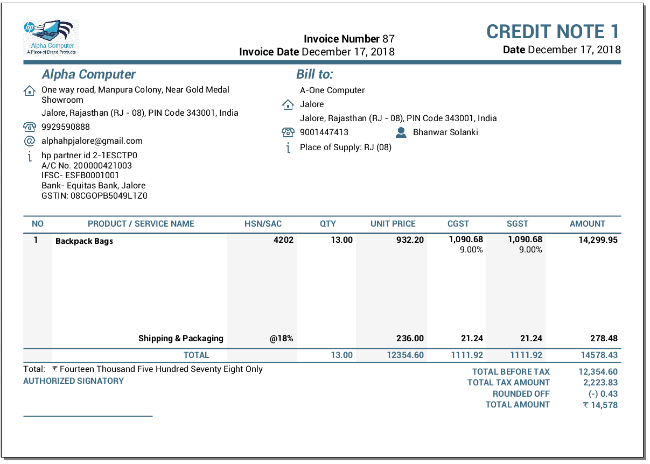

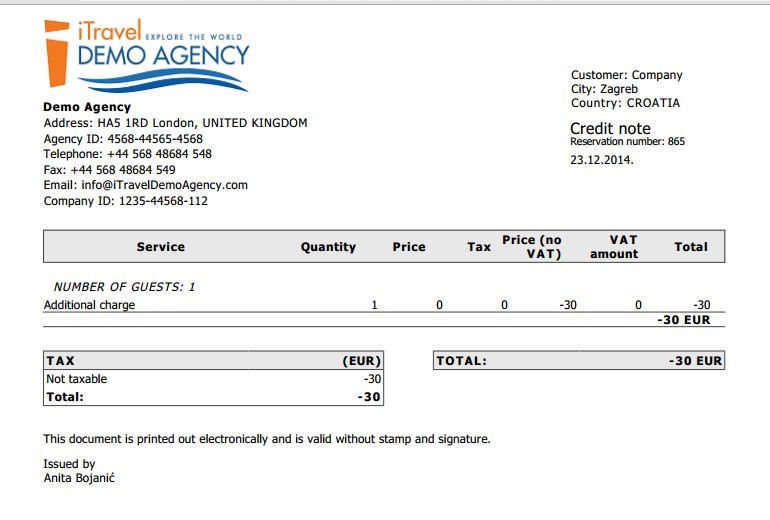

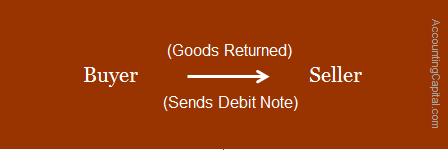

What is debit note and credit note with example. It can be sent by the seller when he receives back the goods. To understand the concept of debit note we need to dig deep. When a seller receives goods returned from the buyer he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note. That s why we will see how it affects the books of accounts of both buyer and seller.

We will take an example to illustrate this. Credit note can be sent by the seller when he has overcharged the buyer. It can be sent by buyer when he has been undercharged. Debit note is written in blue ink while credit note is prepared in red ink.

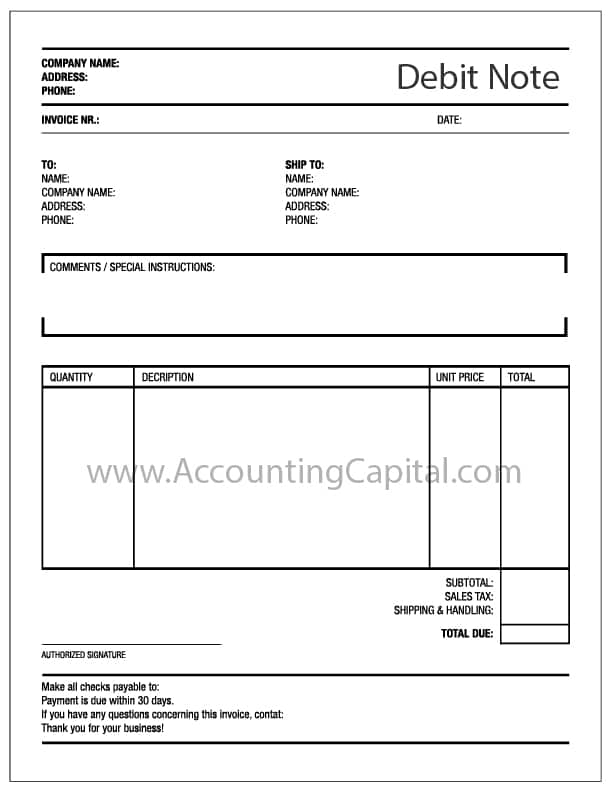

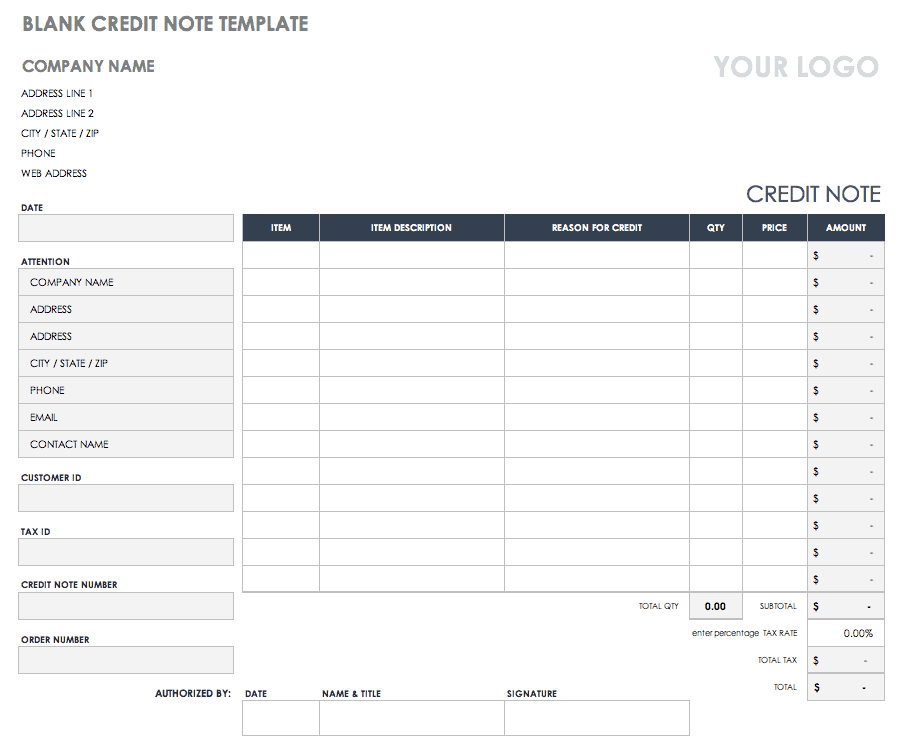

Unlike thank you notes examples credit notes were made for instances were mistakes arise such as overstatements or understatements of values and damage of goods and services credit notes notifies the business in a formal and orderly manner the mistake. If you normally issue debit notes to suppliers from whom credit is due the debit notes must show details similar to those required for credit notes. Another form of. Debit note represents a positive amount whereas credit note prepares negative amount.

Purpose of a credit note. A credit note is a similar articulated form of sales return and informing that the purchase return is being accepted. A credit note is sent to inform about the credit made in the account of the buyer along with the reasons mentioned in it. A record of all credits received from your suppliers must be kept.

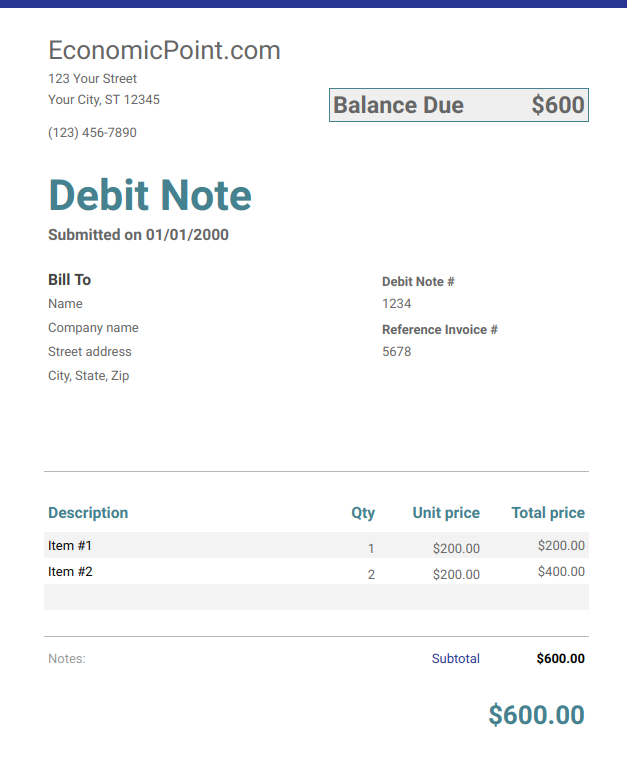

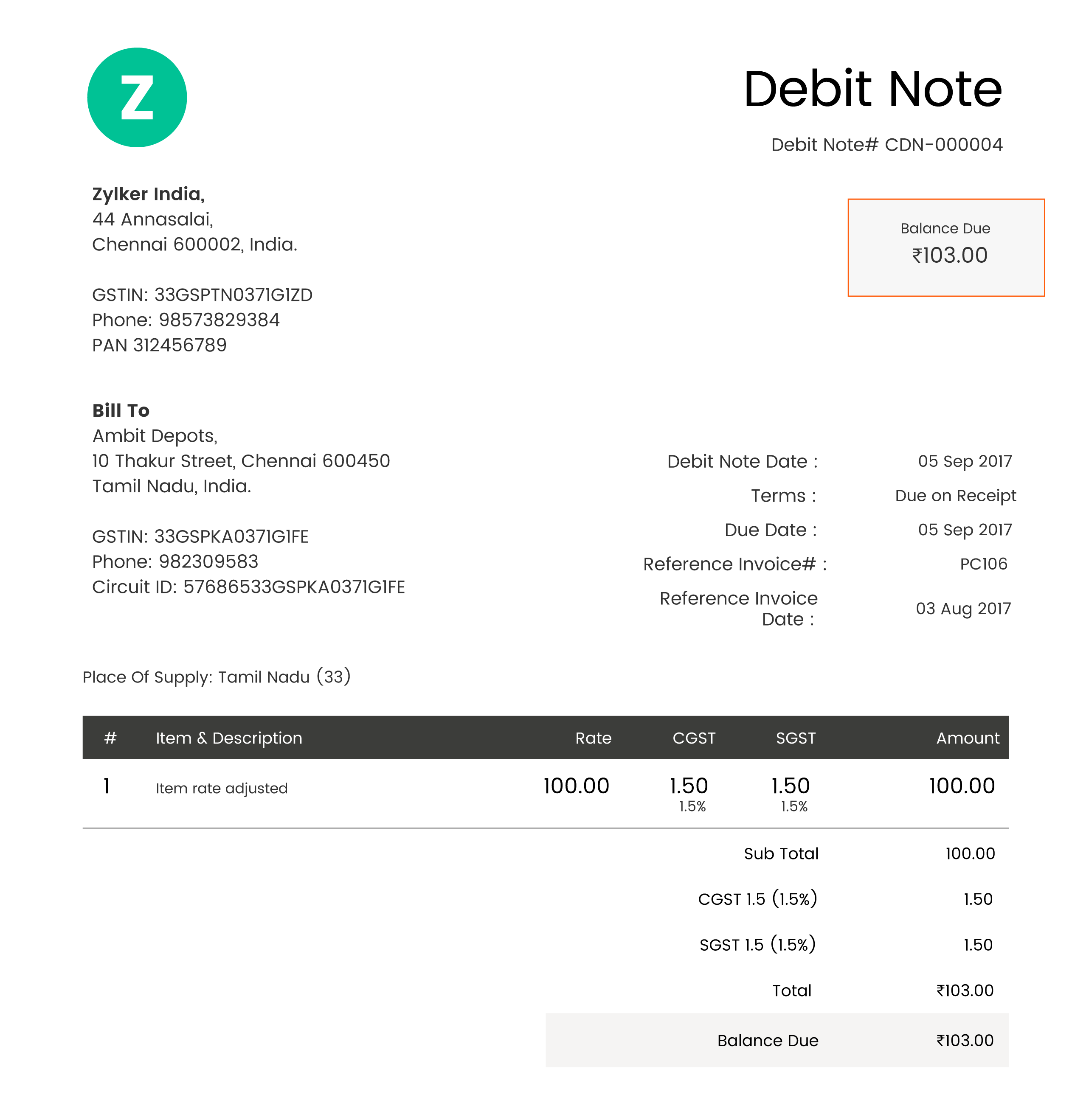

When credit note is sent. On the basis of the debit note purchase return book is updated. Debit note is issued in exchange for credit note. Accounting for debit note with example.

Conversely sales return book is updated with the help of a credit note. It is the articulated form of purchase returns to the seller and intimating the reason behind it. On the other hand credit note reduces payables. Sales returns of goods.

Also do have a look at debit note vs credit note. In the world of business it is important to have a documentation of everything that has been done good or bad. Another example debit note when x issues debit note to y y has to pay money to x. Debit note reduces receivables.