Statutory Income From Employment Gross Or Net

For self employed there are more ways to confirm your income available to a lender compared to a client who is salaried or hourly.

Statutory income from employment gross or net. I need to cover 25points in pervious earning i e. Is â 26000 is considered as gross income or net profit by the case worker for awarding me 25 points. Dear members i am going to apply hsmptier 1 extension. Statutory income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the income tax act.

These boxes refer to canada pension plan and quebec pension plan contributions. Usually only one will be filled in unless your employee worked in more than one province. Gross income is all sources of. For any statutory employee the employer must pay all of of the required payroll taxes including social security and medicare to the internal revenue service.

And self employment and unearned income such as dividends and interest earned on. Gross income for business owners is referred to as net business income. You should report the gross income not the net. If a self employed applicant states she earns more income than her personal income tax return is showing then a lender will review the gross and net business income.

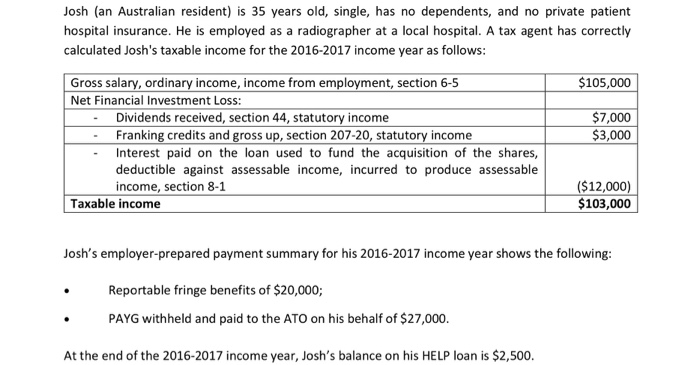

The remaining amount 5 000 366 25 will be used to offset his income tax payable in subsequent years until the rebate has been fully utilised. Box 16 17 employee s cpp qpp contributions. Do not carry net statutory income to schedule se. A statutory employee s business expenses are not subject to the reduction of 2 of their adjusted gross income.

64 year old with employment income of 250 000 in 2019. Income related reduction to the higher personal allowances where you were born before 6 april 1938 and have an adjusted net income of over 27 700 tax year 2015 to 2016. Instead file a separate schedule c for each type of income. Illinois marriage and dissolution of marriage act defines the net income of a person for the purpose of determining child support payments as the total of all income from all sources minus the following deductions.

An employee who is allowed to deduct expenses on schedule c business income or loss is a statutory employee although he or she still receives a w 2 from an employer. Do not combine statutory employee income with self employment income. 26000 gbp my turnover is â 35000. Net pay is the amount an employee takes home after all deductions are made from their gross pay.