Stamp Duty Exemption Malaysia Love And Affection

Love and affection transfer malaysia 2020.

Stamp duty exemption malaysia love and affection. Called love and affection. By melissa lee 2019 12 27t17 54 22. Love and affection transfer is a transfer of property between immediate family members with an exemption of stamp duty. Stamp duty exemption for first time house buyer 2019.

Stamp duty is calculated on the market value of the property at the time of the acquisition whereas rpgt is calculated on the profit gained from the disposal of the property. Stamp duty exemption for mot. Transfer of property malaysia. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949.

General exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. Duty previously known as stamp duty is a form of taxation charged by the state government under the duties act 2001 when someone acquires an interest in property usually by buying a property. Transfer of property by love and affection malaysia. Stamp duty legal fees for purchasing a house 2020.

The type of property and the way it is acquired can impact the way that duty is assessed. Call us now. In this context love and affection transfer family member means between spouses and parents and children. In contrast pursuant to the stamp duty exemption no.

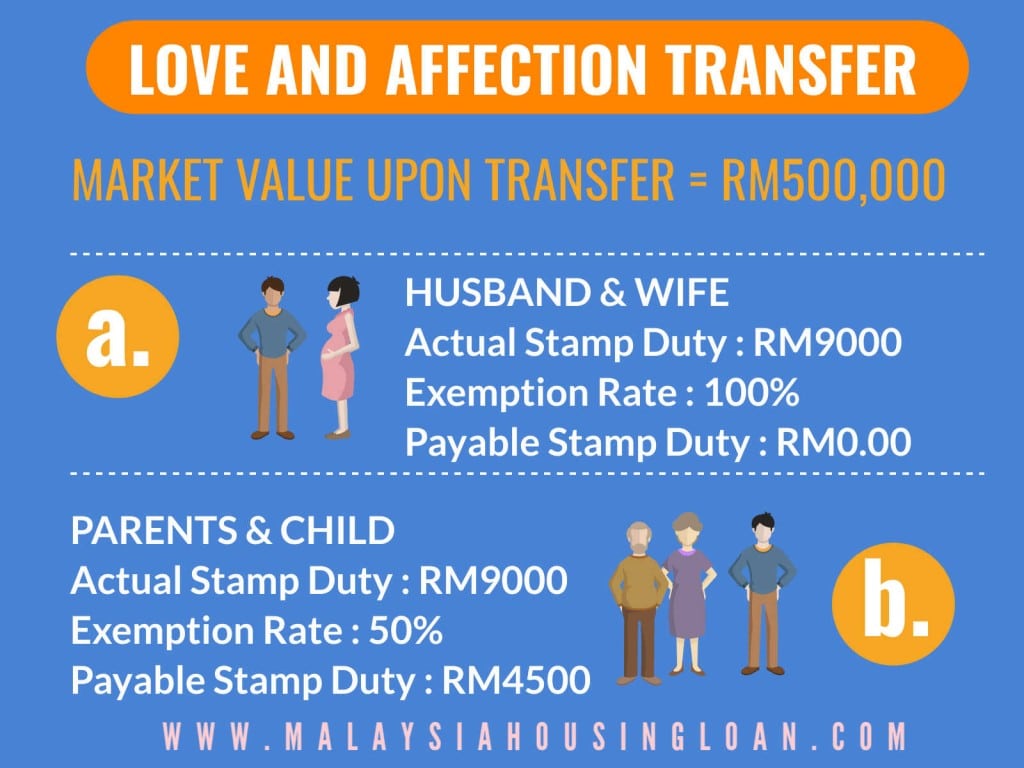

The law does provide for a stamp duty exemption for a transfer of property by way of love and affection. Instruments liable to stamp duty. A transfer on love and affection generally an acquisition of property attracts stamp duty exposure and a disposal of property may attract real property gains tax rpgt. Sovo sofo and service apartment property.

This consideration only applies when the transfer is from parent to children vice versa or from spouse to spouse. Yes i repeat it is a free service. Transfer of property by love and affection malaysia. In the case of a transfer of property between family members by way of love and affection the law provides for a full or partial exemption of stamp duty and or rpgt in certain instances.

Exemptions relief from stamp duty. Seller quotation for sub sale property malaysia. 10 order 2007 the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows. Don t worry we will.

1 what is a transfer by way of love affection. 2 who are close family members. It is a transfer of property between close family members. Stamp duty is calculated on the market value of the property at the time of the acquisition whereas rpgt is calculated on the profit gained from the disposal of the.

Stamp duty calculation malaysia 2019 and stamp duty malaysia exemption stamp duty malaysia 2019. So the following is a simple breakdown on how mot the stamp duty exemption work among family members in malaysia.