Section 127 3 B Income Tax Act 1967

Following sections of the income tax act 1967.

Section 127 3 b income tax act 1967. Short title and commencement 2. 3 laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Interpretation part ii imposition and general characteristics of the tax 3. 1 notwithstanding any other provision of this act but subject to section 127a any income specified in part i of schedule 6 shall subject to this section be exempt from tax.

Non chargeability to tax in respect of offshore business activity 3 c. History subsection 127 1 is amended by act 608 of 2000 s18 by inserting after the word act the. Type of incentives a incentive for ohq an approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources. Charge of income tax 3 a.

The revised guideline is available on mida s website www mida gov my resources forms and. Short title and commencement 2. Non chargeability to tax in respect of offshore business activity 3c deleted 4. 3 laws of malaysia act 53 arrangement of sections income tax act 1967 part i preliminary section 1.

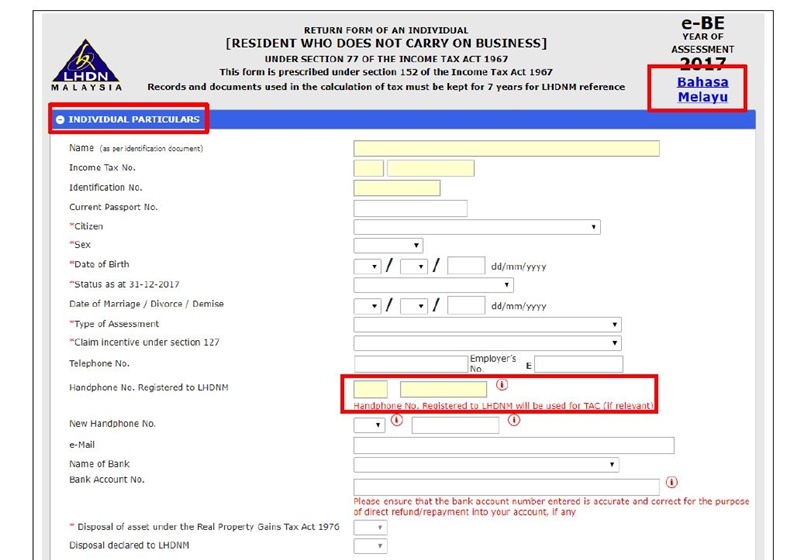

Classes of income. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Section 127 3 b for tier 1 and value added income incentives via a gazette order. Section 127 of the income tax act 1967 ita is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for the incentive offered in the said gazette order.

Scope of exemption granted under section 127. Rujukan kepada akta cukai pendapatan 1967 yang mengandungi pindaan terkini yang dibuat oleh akta kewangan 2017 akta 785 boleh diakses melalui portal rasmi jabatan peguam negara di pautan berikut. Akta cukai pendapatan 1967 akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 atau akta cukai pendapatan 1967 salinan. Business income income arising from services rendered by an ohq company to its offices or related companies.

Interpretation part ii imposition and general characteristics of the tax 3. Section 127 3a for tier 2 3 via an approval from the ministry of finance. Section 140c of the income tax act 1967 and the income tax restriction on deductibility of interest rules 2019 it is stipulated in the rules that the phrase maximum amount of interest referred to in section 140c shall be an amount equal to 20 of the amount of tax ebitda of that person from each of his business sources for the basis period for a y a.