Real Property Gains Tax Act 1976 Latest

In january 2010 the inland revenue board irb issued a set of new guidelines on the latest amendments to the real property gains tax act 1976.

Real property gains tax act 1976 latest. In exercise of the powers conferred by subsection 9 3 of the real property gains tax act 1976 act 169 the minister makes the following order. Chargeable person to be assessed on chargeable gains. This act may be cited as the real property gains tax act 1976 and shall be deemed to have come into force on 7 november 1975. Real property is defined as.

Law reform marriage and divorce act 1976. Unannotated statutes of malaysia principal acts real property gains tax act 1976 act 169 real property gains tax act 1976 act 169 21b duty of acquirer to retain and pay part of the consideration. Real property gains tax. Readers should not act on the basis of this publication without seeking professional advice.

The real property gains tax exemption no 3 order 2018 which was gazetted on 31 december 2018 exempts any individual who is a citizen or permanent resident of malaysia from payment of real property gains tax on the chargeable gain accruing on the disposal of a chargeable asset excluding shares in a real property company if the following conditions are fulfilled. Married women and children maintenance act 1950. Rpgt or real property gains tax is a form of capital gains tax that is only imposed on the disposal of property in malaysia based on the real property gains tax act 1976. 1 in this act unless the context otherwise requires accountant means an accountant as defined in subsection 153 3 of the income tax act 1967 act 53.

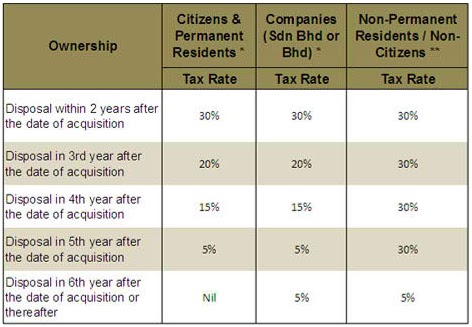

Unannotated statutes of malaysia principal acts real property gains tax act 1976 act 169 real property gains tax act 1976 act 169 11 chargeable person to be assessed on chargeable gains 11. The finance act 2018 act 812 finance act was introduced to amend the income tax act 1967 act 53 the promotion of investments act 1986 act 327 the stamp act 1949 act 378 stamp act the real property gains tax act 1976 act 169 rpgt act the labuan business activity tax act 1990 act 445 the service tax act 2018 act 807 and the sales tax act 2018 act 806. Real property gains tax scope. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc.

The guidelines are known as the garis panduan cukai keuntungan harta tanah referred to as the rpgt 2010 guidelines in this article. Based on the real property gains tax act 1976 rpgt is a tax on chargeable gains derived from the disposal of property.