Incentive Under Section 127 Income Tax

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

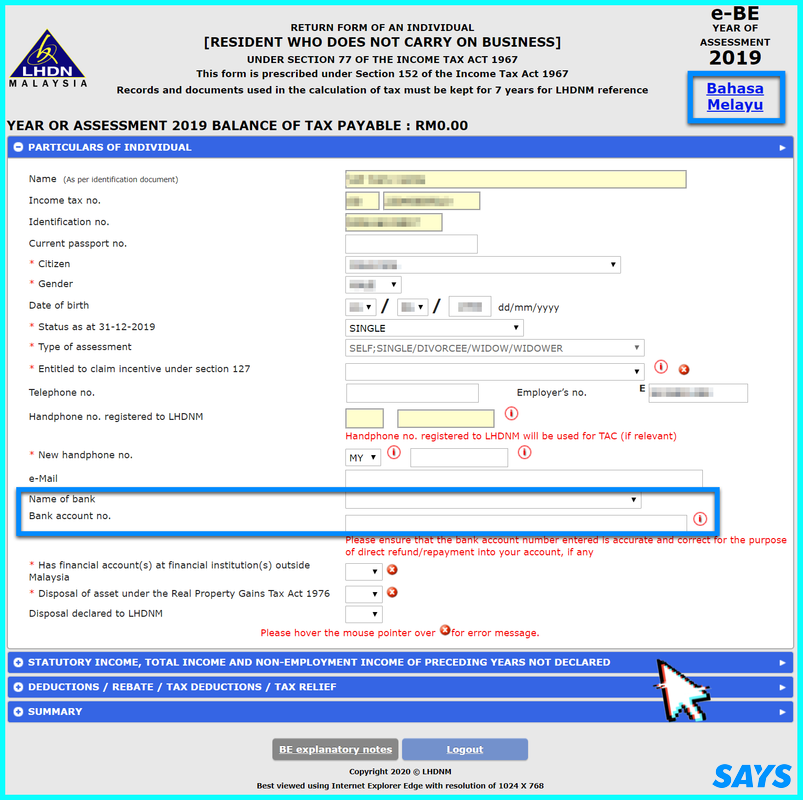

Incentive under section 127 income tax. The said section reads as follows. Section 127 of the income tax act 1961 act for short deals with the power of competent officers to transfer cases. Section 127 of the income tax act 1967 ita is included in the mutual. A7 refers to incentives for example exemptions under the provision entitled to claim incentive under section 127 of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter.

Incentive under section 127 refers to the income tax act 1976. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter. 127 1 the director general or chief commissioner or commissioner may after giving the assessee a reasonable opportu nity of being heard in the matter wherever it is possible to do so and after recording his reasons for doing so. Under schedule 6 is still eligible to enjoy the incentive under any gazette order subject to the conditions therein while those granted the specific exemptions under sections 127 3 b and 127 3a would not be.

Income incentives via a gazette order. Years under section 127 income tax act 1967 for income derived from the following sources. In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Section 127 3a for tier 2 3 via an approval from the ministry of finance.

Business income income arising from services rendered by an ohq company to its offices or related companies. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. Incentive under section 127 refers to the income tax act 1976. Interest income derived from interest on foreign currency loans extended by an ohq company to its offices or related companies.

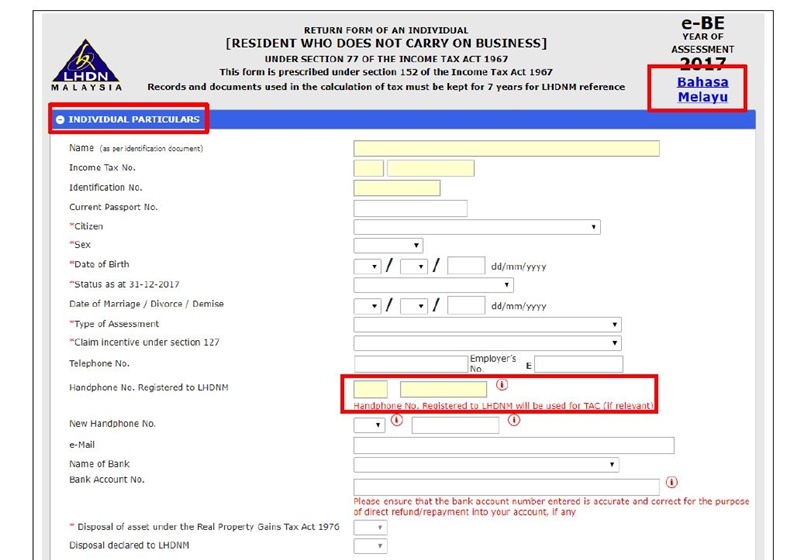

It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter. A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdnm so ensure it is correct. The revised guideline is available on mida s website www mida gov my resources forms and guidelines incentives under the 2015 budget. Paragraph subsection paragraph subsection not relevant.

Claim incentive under section 127 which one to choose. A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdn so ensure it is correct.