Entitled To Claim Incentive Under Section 127 Malaysia Tax

Claim incentive under section 127 which one to choose.

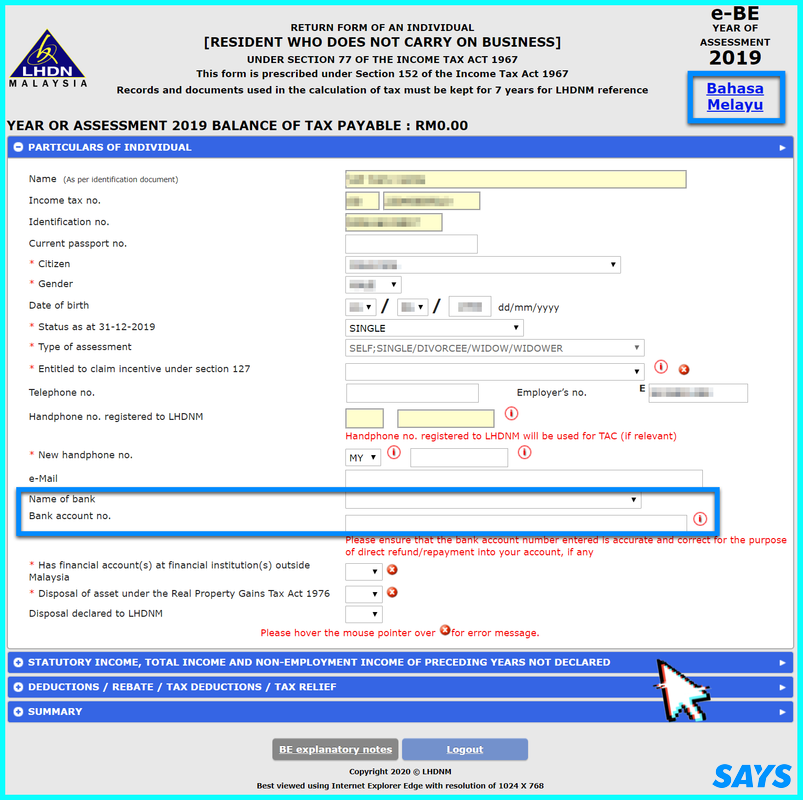

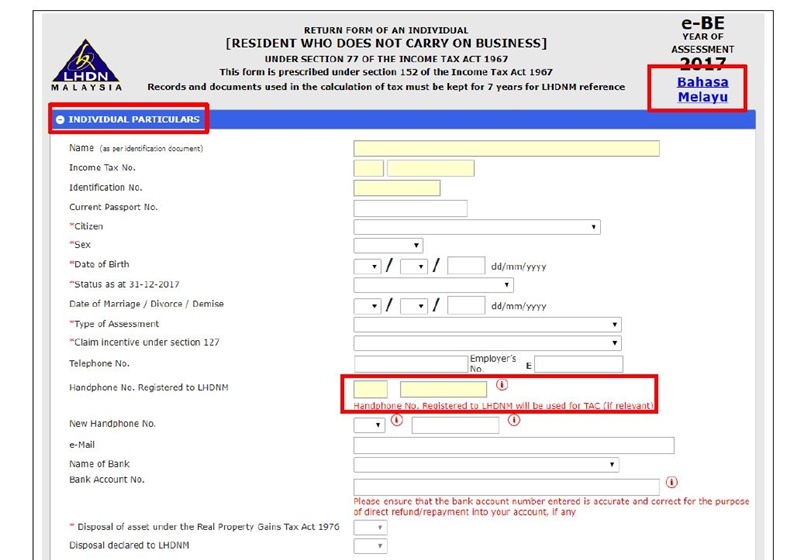

Entitled to claim incentive under section 127 malaysia tax. If you re curious about the entitled to claim incentive under section 127 the dropdown list allows you to claim under paragraph 3 a or 3 b which is listed below. Paragraph subsection paragraph subsection not relevant. In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. I enter x in the box for the type s of incentive.

On 10 april 2017 the income tax exemption no. Business income income arising from services rendered by an ohq company to its offices or related companies. A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdnm so ensure it is correct. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable.

A7 refers to incentives for example exemptions under the provision entitled to claim incentive under section 127 of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter. Incentive under section 127 refers to the income tax act 1976. So unless a minister has statutorily exempted you from certain taxes it s probably not relevant to you.

The tax exemption will be provided under the following sections of the income tax act 1967. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act. If you re under rep you can file under this category business. The revised guideline is available on mida s website www mida gov my resources.

Section 127 3a for tier 2 3 via an approval from the ministry of finance. Interest income derived from interest on foreign currency loans extended by an ohq company to its offices or related companies. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. Years under section 127 income tax act 1967 for income derived from the following sources.

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.