Corporate Tax Computation Malaysia 2019

How to pay income.

Corporate tax computation malaysia 2019. The company can prepare one set of tax computation for ya 2020 based on the accounts from 1 jul 2018 to 31 dec 2019. Malaysia adopts a territorial system of income taxation. To engage qualified tax agent to prepare business accounts if. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Malaysia corporate taxes on. How does monthly tax deduction mtd pcb work in malaysia. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Calculations rm rate tax rm 0 5 000.

Chargeable income myr cit rate for year of assessment 2019 2020. Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows. Income attributable to a labuan business. Tax rate of company.

Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. The basic corporate tax calculator is an excel workbook intended to help companies and tax agents prepare tax computations and tax schedules when filing their tax returns. Malaysia income tax e filing guide. 2019.

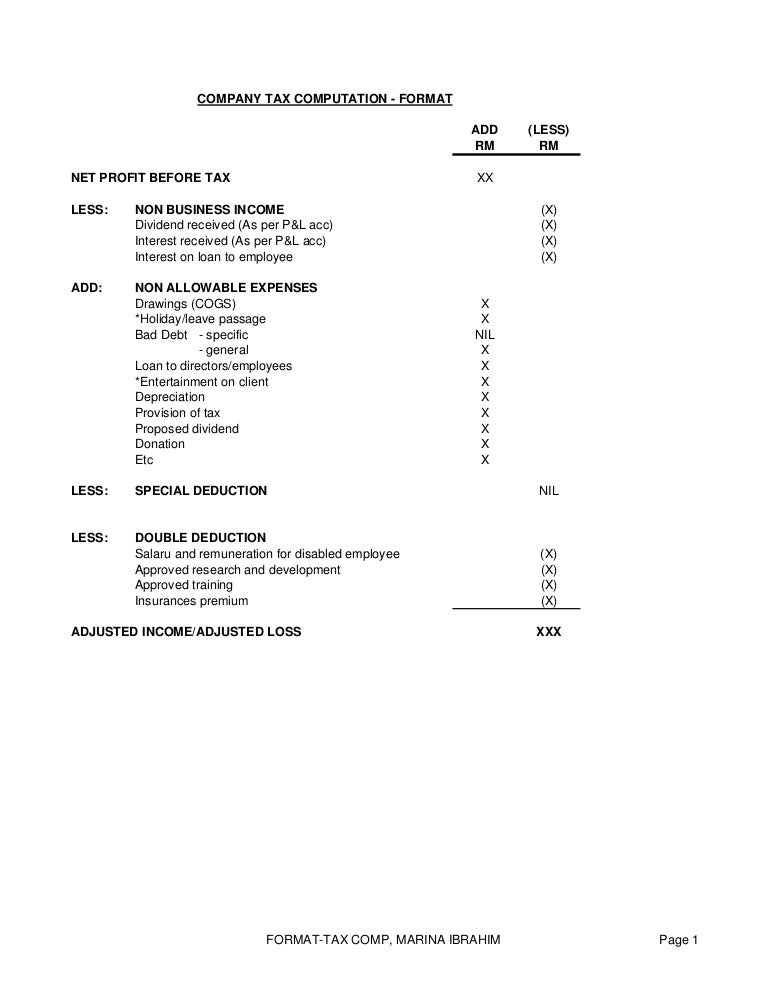

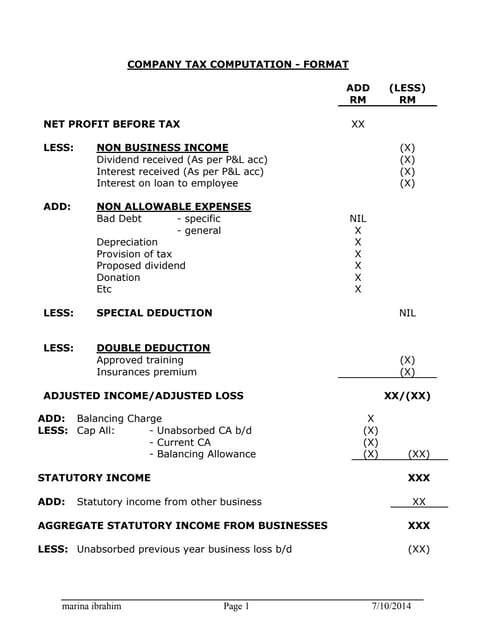

Malaysia corporate income tax rate. The current cit rates are provided in the following table. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Example of tax computation format would be.

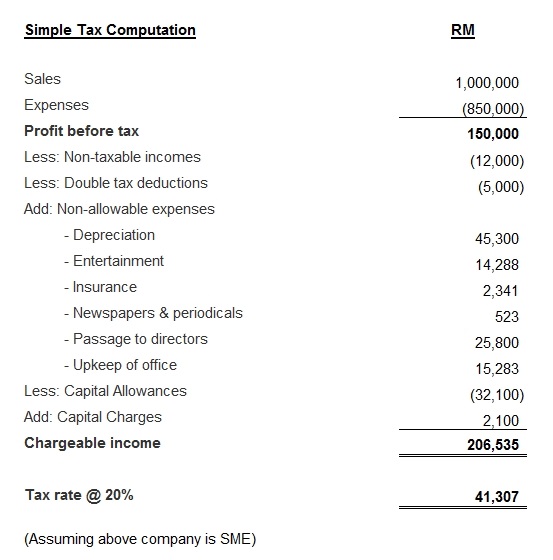

Resident company with paid up capital of rm2 5 million and below at the beginning of the basis period sme note 1 on first rm500 000 chargeable income 17. Using the basic corporate tax calculator. What is tax rebate. A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax.

Corporate income tax in malaysia is applicable to both resident and non resident companies. What is income tax return. In budget 2020 it is proposed that the first chargeable income which is subject to the concessionary income tax rate of 17 be increased from rm500 000 to rm600 000. Visitors this year.

On the first 5 000 next 15 000. For small and medium enterprise sme the first rm500 000 chargeable income will be tax at 17 with effective from ya 2019 and the chargeable income above rm500 000 will be tax at 24. Resident company other than.